tax break refund calculator

It will be updated with 2023 tax year data as soon the data is available from the IRS. And is based on the tax brackets of 2021.

Federal Income Tax Return Calculator Nerdwallet

Tax break refund calculator Friday July 1 2022 Edit.

. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Estimate your tax refund and. Best online tax calculator.

Get your tax refund up to 5 days early. If youre married each. - Opens the menu.

If you are paid as a contractor. Estimate the areas of your tax return. Estimate your 2021 taxes.

When its time to file. You have until April 15th each year to file. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

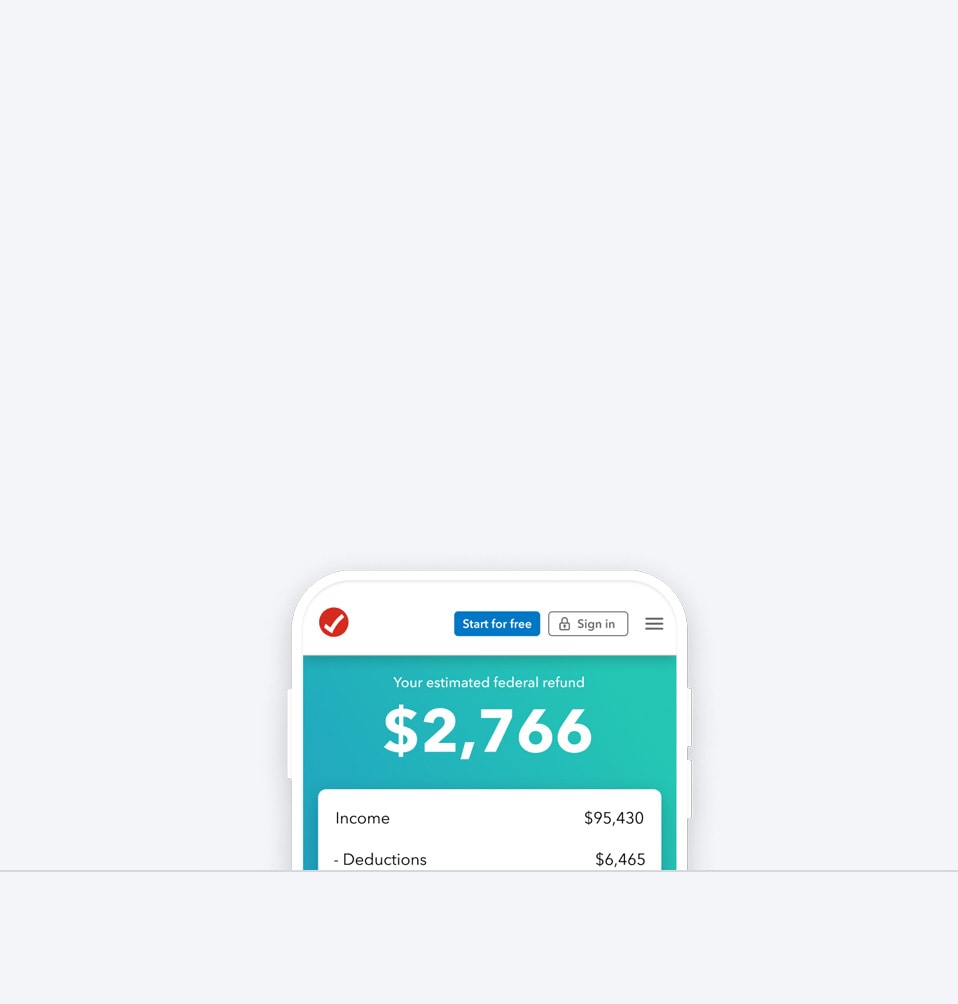

Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator. This means that you dont have to pay federal tax on the. Estimate your federal income tax withholding.

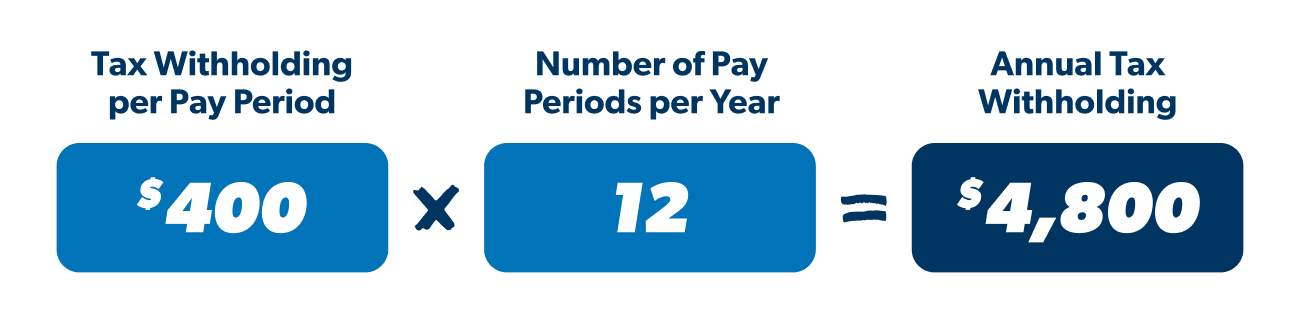

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets. See how your refund take-home pay or tax due are affected by withholding amount.

So doing a little calculation gives us the following. Fill in the step-by-step questions and your tax return is calculated. Prepare and e-File your.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Unemployment Federal Tax Break. This applies even if you are not expecting to receive a refund.

See how income withholdings deductions and credits impact your tax refund or balance due. It is mainly intended for residents of the US. 10200 x 022 2244.

Use this tool to. If you are paid as a contractor you may receive compensation on a 1099-MISC form. Moving on to another example weve a person and they are single.

Use your income filing status deductions credits to accurately estimate the taxes. This is the refund amount they should receive. You may qualify for the tax break up to 10200 of unemployment compensation if your modified adjusted gross income is less than 150000 for 2020.

Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. Get more with these free tax calculators. 100 Accurate Calculations Guaranteed.

It can be used for the 201516 to 202122 income years. Rest assured that our calculations are up to date with 2021 tax.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Tax Breaks For College Students And Parents Bestcolleges

Yearly Federal Tax Calculator 2022 23 2022 Tax Refund Calculator

Tax Refund Estimator Calculator For 2021 Return In 2022

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Here S What To Know On Tax Day If You Still Haven T Filed Your Return

Knowing Novi Tax Breaks Child And Earned Income Credits Diversified Members Credit Union

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

4 Common Ways To Get A Bigger Tax Refund Smartasset

How The 2022 Federal Geothermal Tax Credit Works

Tax Calculator Return Refund Estimator 2022 2023 H R Block

How To Calculate Your Tax Withholding Ramseysolutions Com

Standard Deduction Tax Exemption And Deduction Taxact Blog

Tax Refund Calculator Estimate Refund For Free Taxslayer